Carbon Border Adjustment Mechanism (CBAM)

The EU’s Carbon Border Adjustment Mechanism (CBAM) is a vital measure to prevent carbon leakage by ensuring imports pay a carbon price comparable to that within the EU. It requires importers and producers to closely monitor their supply chains for CBAM-affected goods and accurately report emissions data. It’s essential for stakeholders to adapt swiftly, embracing the move towards a greener economy and aligning with global carbon pricing efforts.

Seamlessly fulfill your CBAM reporting with SupplyOn

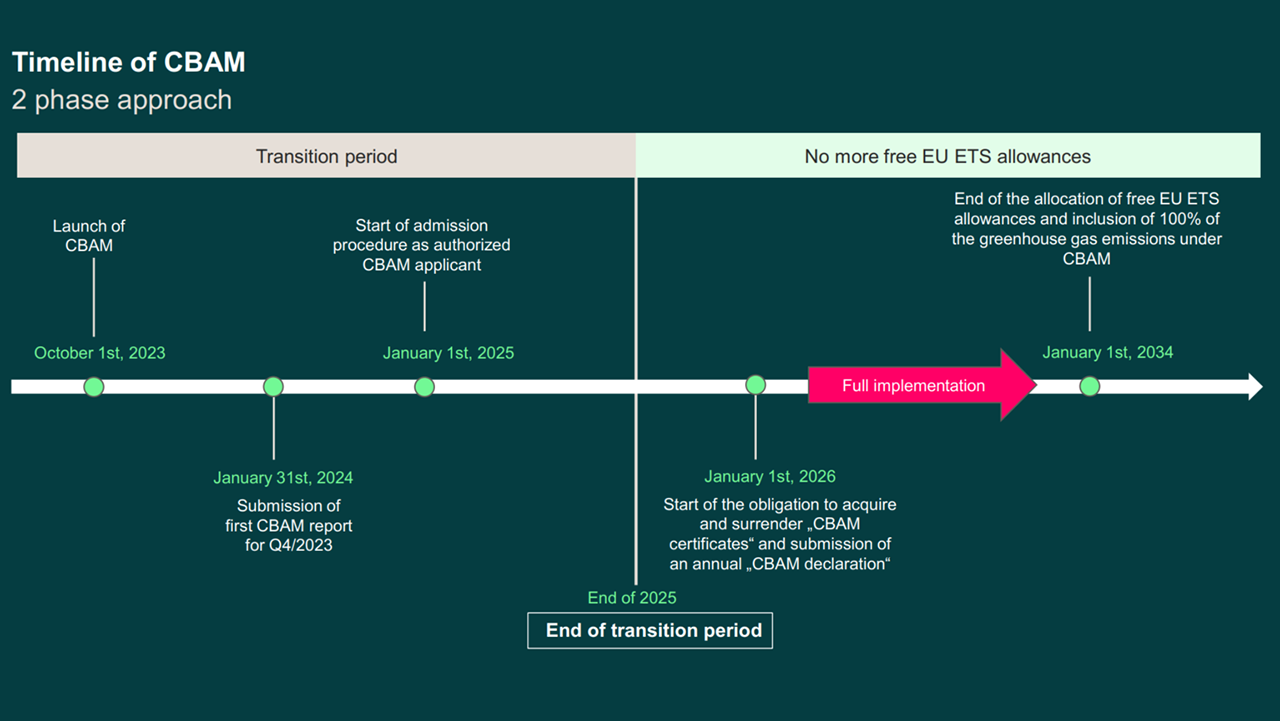

On 1 October 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ended on 31 December 2023 and first report to be submitted 31 January 2024. SupplyOn has long track record in offering complex supply chain solutions including ESG due diligence and reporting. As part of our holistic ESG Suite, our CBAM reporting software allows you to automatically collect CBAM data from your suppliers and prepare your “One Click” report to submit each quarter to support with your compliance.

Reporting obligations:

The transitional reporting (“CBAM report”) has to be done quarterly via the CBAM transitional registry in the definite period, a declaration for the preceding calendar year will be mandatory by May 31 each year starting in 2026. Both reports include:

- Total quantity of imported type of goods in tons (product) or MWh (electricity).

- Total embedded emissions in tons of CO2e emissions (direct and indirect) per ton or MWh

- Emissions must be assigned to individual goods

- Production site must be specified (origin)

- CO2 price paid in the country of origin → certificate (proof of payment)

- Total number of CBAM allowances corresponding to total embedded emissions to be surrendered, after mitigation based on CO2 price paid in a country of origin

The CBAM initially applies in the following sectors:

- Cement

- Electricity

- Fertilizers

- Iron and Steel

- Aluminium

- Hydrogen

All goods for which the embedded emissions must be reported are defined by their CN codes (Combined Nomenclature) listed in Annex I to the CBAM Regulation. These are called ‘CBAM goods’.

SupplyOn CBAM Reporting Manager

- Selection and upload of CBAM imported goods

- Data collection of product specific emission data from installation sites with automated data collection engine

- Management of data collection including status of progress

- CBAM report generation including in XML format

Automation

All workflows for data collection are mostly automated across entire journey

Turn Key Software

Quick activation of the software to get you started for your upcoming quarterly reporting

Reporting

CBAM aligned reporting capability with one click and in XML format for direct upload

Compliance

Methodology is entirely developed to fulfill the requirements and legally aligned with a renown law firm

Carbon Border Adjustment Mechanism Reporting

Learn everything you need to know about the EU’s Carbon Border Adjustment Mechanism (CBAM) and its reporting requirements. Our whitepaper provides essential insights into this groundbreaking initiative and its implications for businesses.